Schedule Personal Property - We use cookies to improve security, customize user experience, improve marketing activities (including working with our marketing partners) and for other business use. .

Click "here" to read our cookie policy. By clicking "Accept" you agree to the use of cookies. Can't read

Schedule Personal Property

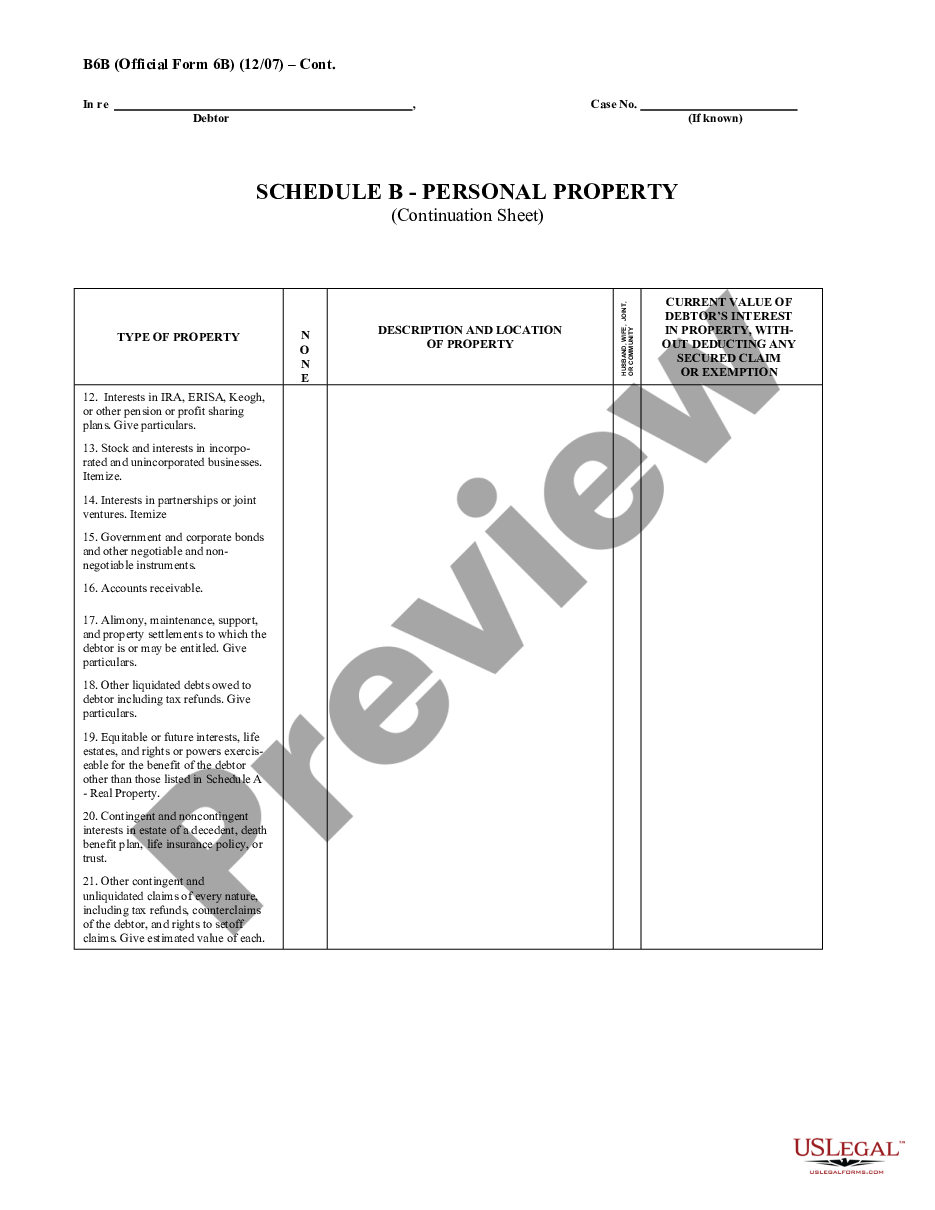

This form is schedule B. The form can be used to list information about a specific type of property; Description and location of personal property; and the current market value of the mortgage interest on the property. This format is an open database conforming to the CM/ECF electronic filing standard. This form is intended for application cases after 2005.

Iaao Research Exchange

Use the most complete legal form. US Legal Forms is the best place to find Personal Property - Schedule B - Form 6B - Template Post 2005. Our service provides 1000's of legal documents designed by licensed attorneys and classified by state.

To receive templates from US Legal Forms, users must first register for an account. If you have already registered in the service, log in and select the document you want and buy it. After purchasing the templates, users can find them in the My Forms section.

Save your time and effort by using the platform to search, download and fill the registration form. Join the many happy applicants who have already used the US legal form!

Schedule B Form Pdf Schedule B Sample Schedule B Online Form Any Claim Schedule B Complete Claim Form Schedule B Form Blank Schedule B

The Bankruptcy Schedules

Schedule B is used to report interest and/or dividends. Taxpayers should use Schedule B if they: Have interest or dividends of more than $1,500. Earn interest from sellers and buyers who use the property as a residence.

If you file a biweekly schedule, you must file Form 941 with Schedule B. This decision applies if you: Reported more than $50,000 in employment taxes during the review period. Accumulated tax credit of $100,000 or more on any day of the current or previous calendar year.

Schedule B reports the income and dividends you received during the fiscal year. However, you do not need to file a Schedule B every year you receive interest or dividends. In 2020, for example, Schedule B is not required unless you earn more than $1,500 in interest or dividends.

Schedule B is an IRS form that must be completed if the taxpayer received ordinary income and/or dividends during the year. Schedule B is also used to report less interesting forms or business distributions to individuals.

U.s.c. Title 11

Recommended. Schedule B reports the income and dividends you received during the fiscal year. However, you do not need to file a Schedule B every year you receive interest or dividends. In 2020, for example, Schedule B is not required unless you earn more than $1,500 in interest or dividends.

Use Schedule B (Form 1040) if any of the following: You have taxable interest or ordinary dividends of more than $1,500. You have received interest from mortgage brokers and home buyers. You benefit from the bond.

To complete Schedule B, first separate all documents reporting interest payments. Then you will be listed in Table B for each payer and the corresponding amount. The next step is to add these numbers together. Then you'll deduct interest that's unmatched, such as interest on U.S. Treasury bonds. When you file for Chapter 7 bankruptcy, you must fill out several forms called "schedules," in which you provide information about your assets. , debt, etc. The following is a brief discussion of each table and the type of information it requires. For more information on other parts of the petition, see our article on bankruptcy petitions.

On Schedule A, you will declare your ownership interest in any property you may own. This includes your home, condo, land, or other type of property. When filling out Schedule A, provide the location and description of the property, the value of your interest in the property, as well as the amount of any secured claims (such as mortgages or mortgages) that may be attached. in possession at the time of installation. .

Vector Illustration Human Life Insurance Metaphor Umbrella As Protection Of People From Accidents With Life And Personal Property Accident Insurance Schedule Design Stock Illustration

Schedule B requires you to list all of your personal property, which is anything you own other than real estate. This includes assets such as bank accounts, household items such as furniture, cars, clothes, money, insurance, musical instruments, valuables, stocks, bonds Cards and income, and property other valuables.

A list of the types of assets that must be disclosed on this form is included in Schedule B. You should make sure that you include all of your personal possessions, even those that you suspect are less valuable. If you intentionally fail to disclose your assets, your exemption may be denied, and you may be charged with fraud.

When estimating the value of your personal property for purposes of completing Schedule B, use the property's replacement value - how much would it cost to buy something of the same age and condition? You may need to determine how much the seller is willing to pay for the item. The rule is that customers should use garage sale or yard sale prices when ordering. Some items such as cars, however, can use standard measurements such as Kelly Blue Book or NADA.

A quick note on real estate appraisals: We tell our clients to ask a real estate agent or real estate agent to do a market survey on the property. We feel that a comparative market analysis is a better representation of real estate prices than listings on sites like Zillow.

Top Realtor Daily Schedule

Chapter 7 bankruptcy is often referred to as "bankruptcy," because when you file for Chapter 7, the bankruptcy trustee assigned to your case retains the power to sell your assets without prejudice to pay off the debt. what you owe to the lender. If the property is satisfied, the payment is guaranteed.

The types of assets that can be seized vary from state to state, and at the federal level. Therefore, the type and amount of assets you can keep depends on the bankruptcy laws in your state. See our article on amnesties in New Mexico for more information.

Regardless of state, Schedule C must list and claim exemptions for all assets included in your application. Of course, these are some of the most important forms to include in your bankruptcy petition. To properly and completely fill out Schedule C, you need to determine which bankruptcy exemptions apply to you, and do thorough research on each one. If you are not sure whether your portion of the estate is actually satisfied, consult with a qualified Albuquerque bankruptcy attorney or a bankruptcy attorney familiar with the exemption laws in your area.

If you take out a loan and pledge it as collateral, the lender has a secured claim against you. If you do not pay this loan, the lender generally has the right to repossess the property using foreclosure or regular repossession methods. A loan or mortgage is the most secure type of loan, and if you don't pay it, the lender can repossess your care or your home. You have the opportunity to indicate that you want to maintain your security obligations and therefore the related security; This process is called reconfirmation.

Free Wisconsin Personal Property Bill Of Sale Form

On Schedule D, list the insured claims that may cover your property - not limited to your home or car. When you fill out Schedule D, you must provide the lender's name, contact information, the amount owed on your property, the nature of the loan, the date of the loan, and the description and valuation of property. Creditors owe money. If the value of the liability is greater than the value of the property, you must provide the difference in the column labeled "unsecured portion."

Some types of debt cannot be discharged when you file for bankruptcy. These debts are called priority claims. Certain taxes (see the article on determining whether a tax debt can be discharged in bankruptcy) and spousal or child support, for example, qualify as a priority. These debts must be listed on Schedule E.

Schedule E provides guidance on the types of debts that will be considered priority claims, and therefore must be placed on the schedule. Even if you think that only some of the applications are entitled to priority, you must declare the total number of applications, although you can specify the number of non-priorities in of the given column.

On Schedule F, you list the unsecured debts in your name. It will be

Scheduled Personal Property Coverage

Personal property, tangible personal property schedule, business personal property insurance, schedule a personal property tax, personal property damage lawyers, business personal property, personal property depreciation schedule, homeowners insurance personal property, personal property tax software, personal property insurance, schedule b personal property, personal property damage attorney

0 Comments